Stay Informed with Learnings from SSB

THE BUDGET

One of our highest priorities is to make processes and procedures, like the budgeting process, Surveillance Impact Reports (SIR), and Racial Equity Toolkit (RET) at the City of Seattle accessible, understandable, digestible, and actionable for all of us in our community.

IMPORTANT LINKS

for the Seattle City Budget

-

-

Item description

-

-

-

-

https://kingcounty.gov/en/independents/about-king-county/king-county-tv

Note: BCL = BSL, glossary doesn’t have BSL but city uses both terms

The budget process at the City of Seattle has been made intentionally inaccessible.

The learning curve one must accomplish prior to engaging the City Council or any of the City Department Leads without being forthright dismissed, discredited, gaslit, or even arrested for asking questions or refusing to be silenced, let alone engaging meaningfully is an incredible task that many people simply don’t have time for.

This by itself is a barrier to civic engagement by most of the public.

In addition to that, for most of the nine months leading up to the open debates and deliberations in City Council during the budget session in the Fall, the majority of the negotiations and decisions are happening in private meetings behind locked doors where the public is not welcome. Then when the budget session does commence, the majority of the meetings are held in the morning and early afternoon when most of our community is at work or school and cannot afford the time off to actually participate. Slamming a smorgasbord of the most important decisions of the city into a 45-60 day window is a whirlwind haze of negotiations and decision making, even for the initiated. By the time the City Council actually has an evening meeting when the public can weigh in on the budget for the city for the upcoming year or two, the budget is all but determined at that point. The amendments and horse-trading have already occurred, and there is not much else that is going to influence or augment the enshrined document.

This is public engagement in name only as it utterly lacks any meaningful intention.

Adding fuel to the fire, Council Members like Sara Nelson are also notorious for vilifying those of the public who can actually participate in the budgeting process. She has slandered and defamed activists and community organizers, and put herself as a direct opposition to most of the community. To sustain this position of impassivity and intolerance to political dissent she has weaponized the police and other carceral structures to repress and suppress opposition.

It is ironic that an elected position is a position of service to the community but instead of Seattle’s Mayor or City Council Members behaving as if they are in service to the public, they behave as if they are autocratic rulers. A prime example of this is the expansion of the punitive and carceral system in the face of irrefutable evidence to their efficacy, the expansion of the “SWEEPS” of people who are sleeping on the streets without adequately providing

services or reasonable alternatives, and cutting funding to social services all at the same time. All of this is happening amidst the cacophony of testimony and articles and demonstrations, amidst the public outcry from citizens, residents, directly impacted people, service providers, activists, organizers, business owners, and nonprofit advocacy organizations. Our local elected officials act how they are going to act regardless of the public sentiment. That is both unaccountable to the people they are supposed to serve, and autocratic in character and impact.

It is like our supposedly ‘democratic’ and ‘progressive’ Pacific Northwest elected officials have been studying Donald Trump's rhetoric and style and decided to incorporate and internalize his toxic masculinity and white supremacy.

The City Council is under the misconception of confirmation bias while the community is suffering from its symptoms. When the public is not engaging in the process–usually, because of the barriers listed above–they take it as tacit agreement of the agendas they are pushing forward. When the public is able to mobilize–because for one, there was enough warning before the decision was made to actually inform the public, and two, the issue was egregious enough to inspire people to sacrifice their wages for a day to attend–we are gaslit and defamed as it is claimed that we do not know enough about our own lives and experiences to have a relevant opinion. As such, when the people do engage, we are dismissed without regard. They act like their position provides them with a rubber stamp to do as they please and assume that everything proves their points.

Our elected officials have made chambers a hostile environment and participating in civic engagement inconsistent with our wellbeing. The sad part is that the system is not broken, it is functioning precisely how it was intended. If it wasn’t intended to function in this manner, then they would not have been able to accomplish it so easily. For those of us who have been around long enough to remember more conciliatory and amenable councils, we can now see that was a choice and not the measure. The system is laden with barriers, processes, and ideologies that have been designed to discredit and dismiss every-day-community-members and to dissuade us from participating and being successful in the system.

We Aim to Change All That

The following is our attempt to make the budget process accessible and understandable for our community members.

Rough Outline of the Budget Cycle

APRIL

General Fund revenue forecast #1

MAY

Departments prepare and submit budget memos to the City Budget Office (CBO) for analysis and mayoral consideration

JUNE

City Budget Office (CBO) receives departmental operating budget and Capital Improvement Program (CIP) submittals

AUGUST

General Fund forecast #2

OCTOBER

The Mayor is obligated under state law to submit a proposed budget by October 3rd each year (which is 90 days before the start of the next fiscal year). Usually, the Mayor releases the proposed budget sometime in September

City Council begins facilitating Budget Committee Meetings

NOVEMBER

Budget Committee Meetings continue

Chair of the Budget Committee will propose an initial balancing package to the budget, which will include changes City Council proposes to the Mayor’s original proposal

DECEMBER

Under WA State law, the Council must consider and adopt a budget by December 2nd (which is 30 days before the start of the next fiscal year). Usually, City Council completes this in Mid-November

The above sections highlighted in red are what most think of when they hear city budget process and that is because that is the time when it gets the most attention and when it is open to the public. This is the period of time during the budget cycle when Seattle Solidarity Budget and many other groups, like Services Not Sweeps, Be Seattle, or 350 Seattle make many Calls-to-Action (CTAs) for people to journey to City Hall to provide public comment on the budget and define community priorities for spending public money.

However, there is a lot of negotiation that happens behind the scenes all throughout the year that comprises the Mayor’s proposal which most of us are responding to come the Fall each year. The public has traditionally been barred from participation in much of the lead up process, but that does not mean that is how it has to remain. It does mean that up to this point, the People have been able to have very little influence in the bulk of the budget development or the establishment of meaningful priorities.

It is also the case that the part of the process when the People are included is usually between September and December when public Budget Committee Meetings are being held. However, it is unclear just how much influence the People have on the budget at this stage since the bulk of the budget has already been negotiated and determined by departments such as Parks and Seattle Police, and our elected officials tend to have their own agendas to satisfy.

Nonetheless, it is during this period when we have the greatest opportunity to shift the public narrative about the budget, the values being espoused by it, and the impact to our community members.

(Budget numbers drawn from a 2024 snapshot)

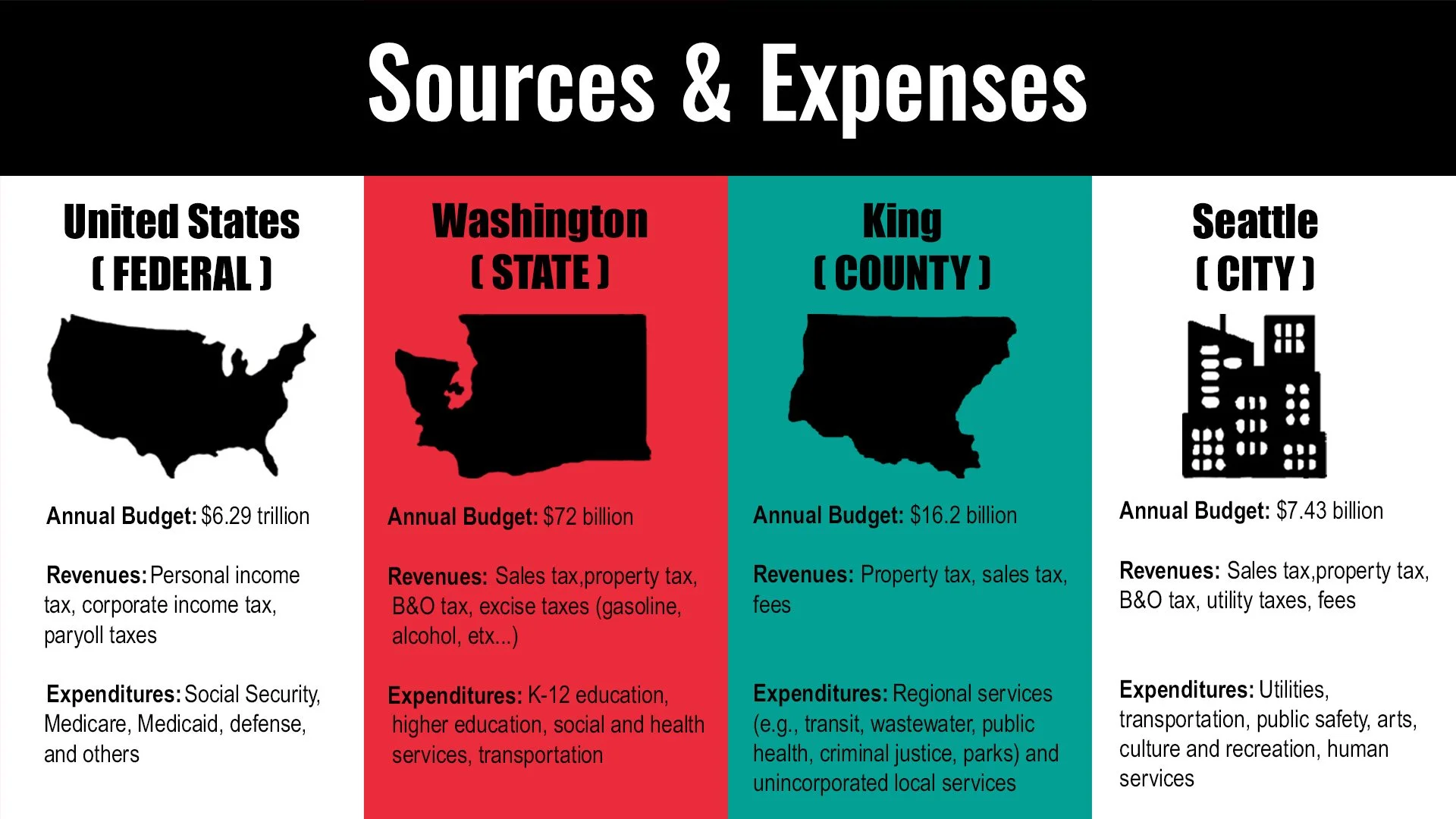

It is important to have an understanding of the volume of money we are talking about at each level of government, where the money comes from, and what they can spend the money on at each level of government. Depending on what programs and services you would like to have an impact on will influence where you choose to focus your attention.

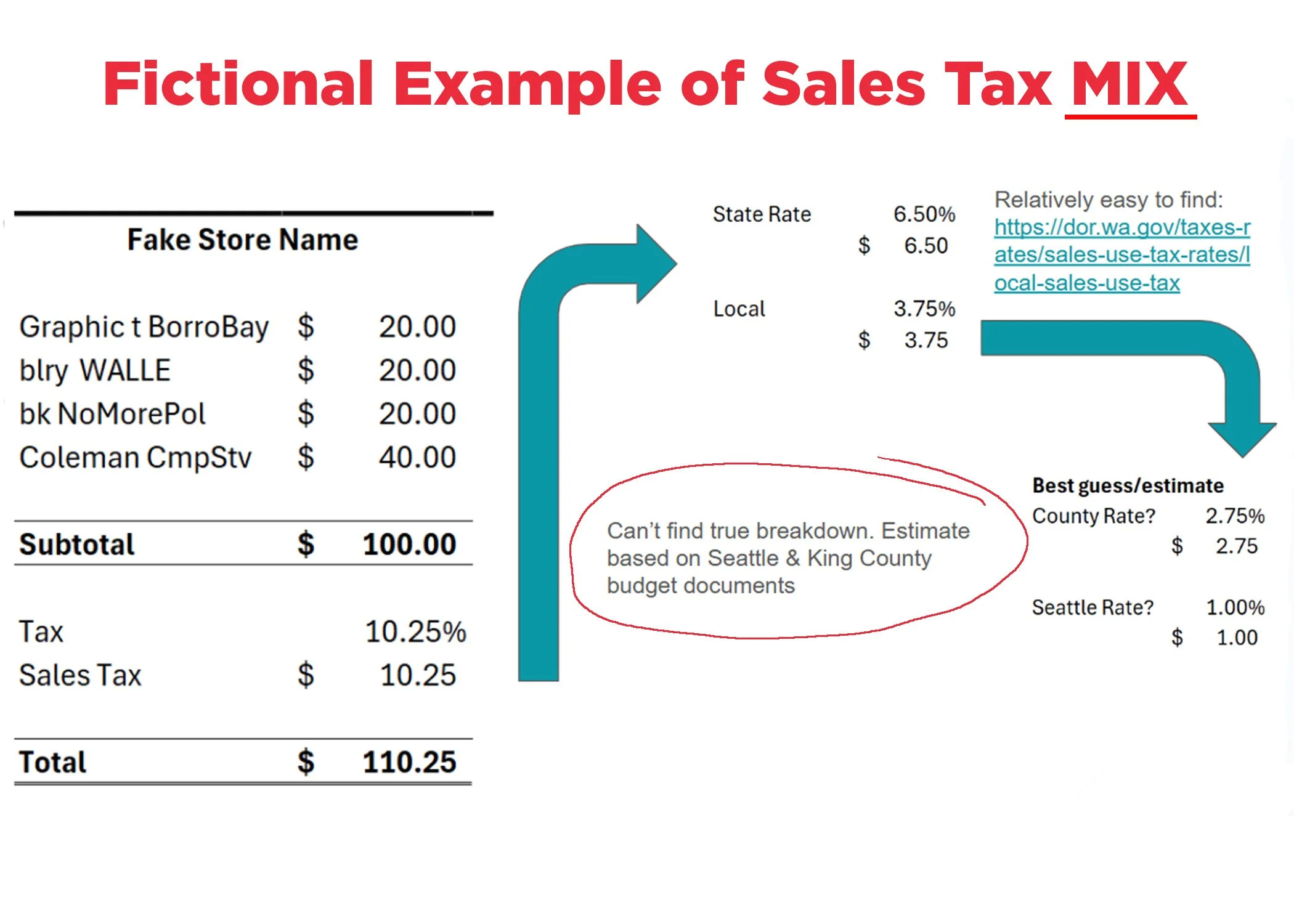

Knowing where they are getting their money from helps us to identify whether the source is “progressive” or “regressive” in nature. The short definition is that a regressive tax is one that is felt more by those with less than with more, while a progressive tax is felt greater by those with more than with less. So, say that we wanted to advocate for providing human services to people who are experiencing poverty, that is, those with less, does it make sense to tax them to raise the money used to assist them? We don’t think so either.

This is why it is good to have an understanding of the source of the money because it is likely that it will relate directly to the thing you want to influence.

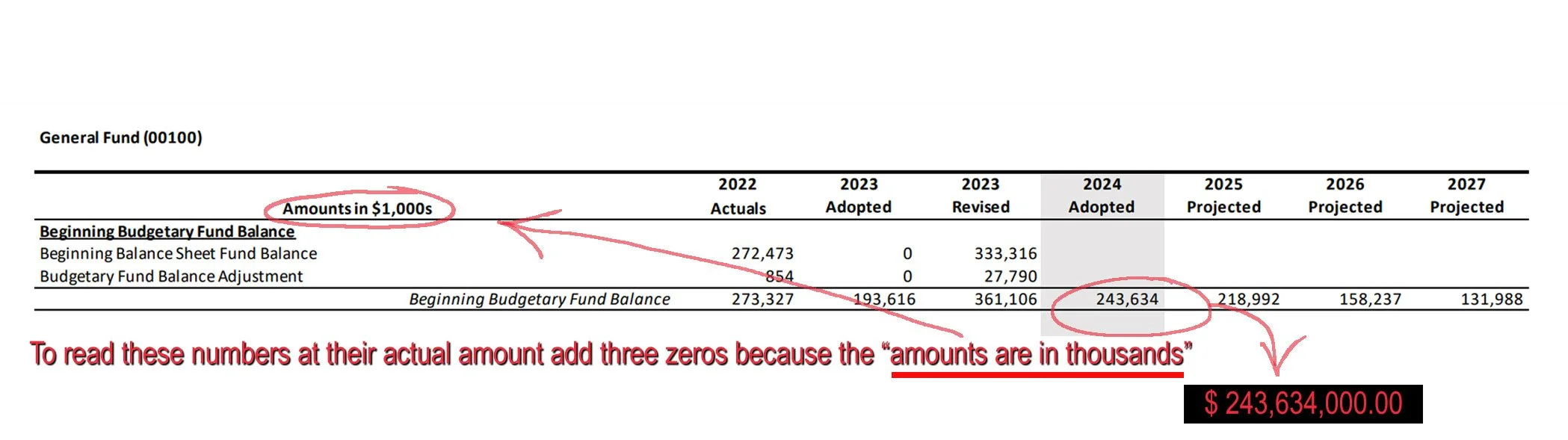

Reading the Numbers

Looking at a budget, one will often see a descriptor that reads something like, “numbers in thousands (1,000s)” or “numbers in millions” or something to that effect. This can sometimes be quite confusing if we are not accustomed to looking at budgets and spreadsheets, even though it can arguably make things easier for those who are.

It makes the numbers look smaller than they actually are and it is difficult to keep in mind the amount that is actually being defined on each line.

To adapt the numbers:

In the case of thousands, then you will need to add three zeros to the number to read the actual amount

In the case of millions, then you will need to add six zeros to the number to read the actual amount

(As shown in the example above.)

Types of Budgets & Sources

City of Seattle

$7.43 Billon Budget (2023-2024 numbers)

Operating Expenses (Recurring Expenditures)

These are ongoing costs necessary to run the day-to-day operations, like salaries, utilities, and office supplies.

-

2024 Numbers

-

It all begins with an idea. Maybe you want to launch a business. Maybe you want to turn a hobby into something more.

-

It all begins with an idea. Maybe you want to launch a business. Maybe you want to turn a hobby into something more.

-

Item description

Utility Service Fees

This is the primary source of revenue for any municipality and is a cost the government mandates for the ownership of property

-

2024 Numbers

-

Electricity for homes and businesses

“the light bill”

-

Item description

-

It all begins with an idea. Maybe you want to launch a business. Maybe you want to turn a hobby into something more.

-

Item description

Capital Projects

These are large, one-time investments in assets with a long lifespan, like constructing new schools, roads, or public buildings

-

2024 Numbers

-

Land and building acquisition

Construction of new buildings

Major repairs, reconstruction, and additions to existing buildings

Utility, landscaping, and infrastructure work

Equipment for facility operation

Architectural planning and design

Engineering studies

Administrative costs

Fees & Penalties

These are the secondary and tertiary sources of revenue for most municipalities

-

2024 Numbers

-

It all begins with an idea. Maybe you want to launch a business. Maybe you want to turn a hobby into something more.

-

$14.4 M

-

It all begins with an idea. Maybe you want to launch a business. Maybe you want to turn a hobby into something more.

Grants

These are the secondary and tertiary sources of revenue for most municipalities

-

2024 Numbers

-

It all begins with an idea. Maybe you want to launch a business. Maybe you want to turn a hobby into something more.

-

Item description

-

It all begins with an idea. Maybe you want to launch a business. Maybe you want to turn a hobby into something more.

Short description of the differences in the uses and expenses of the money and how they are derived

A “fund” in the City of Seattle is an accounting entity that tracks the city's revenues and expenditures. The city uses multiple funds to comply with state accounting and budget rules, and to hold specific projects accountable.

An easy way to think about this is that each fund is a separate account with different staff who manage each account.

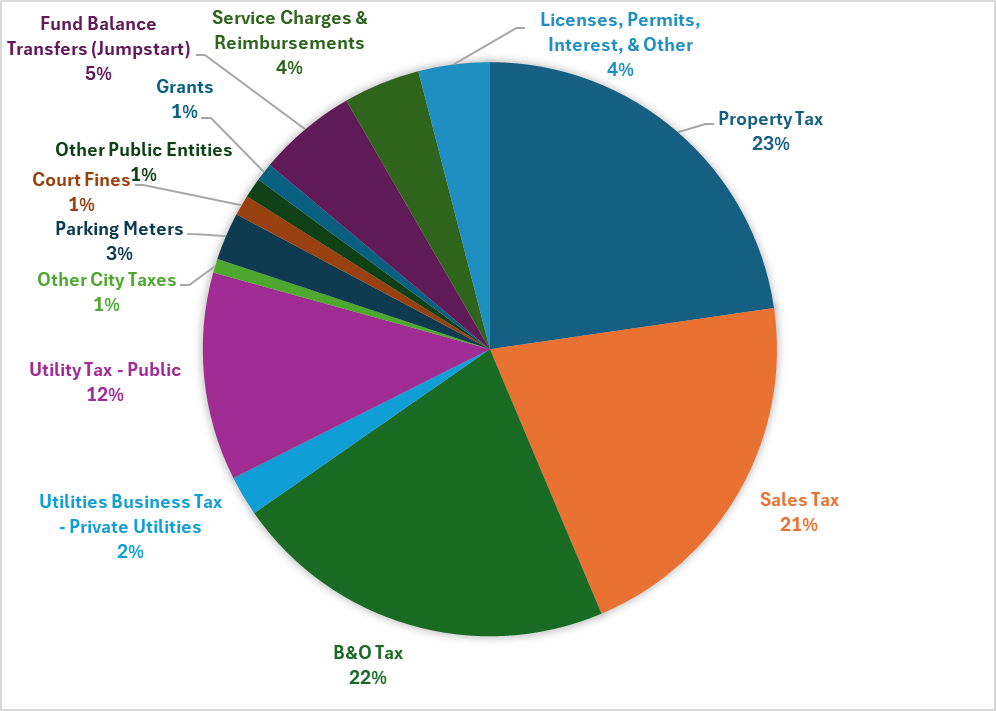

The Seattle City government has four main sources of revenue supporting the services and programs the City provides its residents:

First, taxes, license fees, and fines support activities typically associated with City government, such as police and fire services, parks, and libraries.

Second, certain City activities are partially or completely supported by fees for services, regulatory fees, or dedicated property tax levies.

Examples of City activities funded in whole or in part with fees include certain facilities at the Seattle Center, recreational facilities, and building inspections.

Third, City utility services (electricity, water, drainage and wastewater, and solid waste) are supported by charges to customers for services provided.

The City of Seattle has a legal obligation to ensure revenues from utility use charges are spent on costs specifically associated with providing utility services. As a result, each of the City-operated utilities has its own fund.

Fourth, grant revenues from private, state or federal agencies support a variety of City services, including social services, street and bridge repair, and targeted police services.

The City’s primary fund is the General Fund. The majority of resources for services typically associated with the City, such as police and fire or libraries and parks are received into and spent from one of two funds of the City’s general government operation: the General Fund for operating resources and the Cumulative Reserve Fund for capital resources.

(adapted from the City of Seattle’s description)

Depending on the tax or levy, not all of the money raised by it will go into the General Fund. The pool of money (aka budget or fund) that the revenues go into depends on the legislation of the tax or levy. For example, the Parks Levy fills a Parks Levy Fund that is to be used for and by the Parks Department exclusively. Whereas, Seattle retail sales tax goes directly into the General Fund and either the Mayor or City Council may decide how to allocate the money.

Use JumpStart (Payroll Expense Tax) as an example of a restricted tax revenue source

Taxes & Levies (property tax)

This is the primary source of revenue for any municipality and is a cost the government mandates for the ownership of property

-

2024 Numbers

-

These are terms that refer to whether a pot of money is reserved to a specific purpose, like fixing sidewalks, or whether the money can be used for any purpose.

Some taxes (levies) are “restricted” to particular uses, Like the Parks Levy, while others like Property Tax (in general) is not.

A levy is a tax that property owners pay based on the value of their property, but it is not exactly the same thing as “property tax.” -

It all begins with an idea. Maybe you want to launch a business. Maybe you want to turn a hobby into something more.

-

Item description

-

Business and Occupation Tax is a gross receipts tax. It is measured on the value of products, gross proceeds of sale, or gross income of the business.

-

Excise taxes are taxes imposed on certain goods, services, and activities.

A local example of this is the Sugary Beverage Tax in Seattle.

Other examples include alcohol, cannabis (marijuana), gasoline, etc...

-

Item description

-

Item description

-

Item description

-

Item description